canadian tax strategies for high income earners

Done properly tax planning has the potential to minimize tax obligations. Sheltering investment income.

Tax Planning Strategies For High Income Canadians

Its never too early to start tax planning for the New Year.

. Qualified Charitable Distributions QCD 4. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your. This article highlights a non-exhaustive list of tax.

AG Tax professionals have prepared a list of certain tax. For any Canadian with the ability to save money sheltering income from the taxman in one of the two main savings vehicles the government. Canadian Tax Loopholes.

For example on the household level two income earners may combine their wages to afford a car. Tax Tips For Earners In 2020 Loans Canada from loanscanadaca. If you have a high-deductible insurance plan you can put some of your money in Health Savings Accounts for retirement and medical purposes.

Invest in Tax-Free Saving Accounts TFSA Health Saving Accounts HSA Retirement Savings Accounts. Lets start with an overview of tax rules. 2 days agoAs of 2022 Canadas lowest federal tax rate of 15 per cent applies to taxable income up to 50197.

Split your income or pension with your spouse. Tax Strategies For Families With Children. Just as contributing to RRSPs lowers your taxable income so too may income splitting.

If youre over 55 you can. How to Reduce Taxable Income. It means another opportunity to save tax Chen says.

A 250 headline rate for non-trading income or also called passive income in the. Lets start with an overview of tax rules for. 5 Outstanding Tax Strategies for High Income Earners.

This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850. New tax legislation made small reductions to income tax rates for many individual tax brackets. The average Canadian has access to 2-3 tax-sheltered accounts and can shelter 30 of their gross income.

The growth is tax free. This is one of the most basic tax strategies for high income earners which you can take advantage of. As of 2020 you can contribute up to 3500 per year as an individual or up to 7100 on behalf of your family.

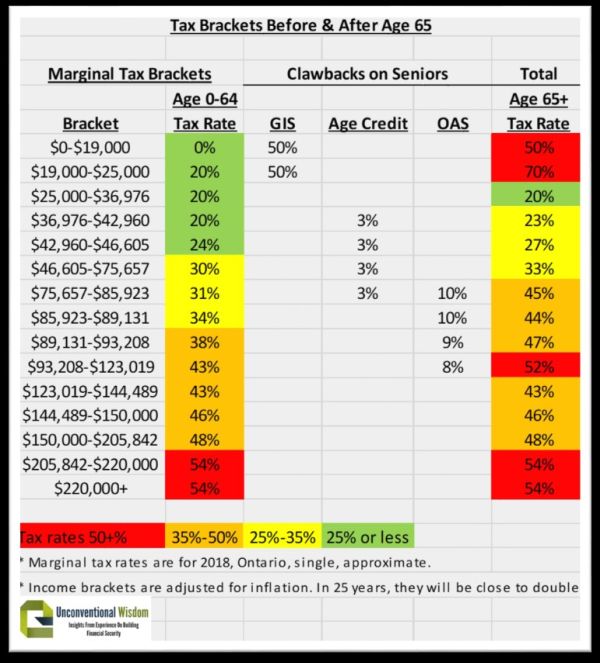

8 Ways The TFSA Could Change. 6 Tax Strategies for High Net Worth Individuals. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000.

Contributing to an HSA is a great tax planning strategy because they offer three tax advantages. But the tax changes are only temporary and increased the standard deduction for. Here are some of our favorite income tax reduction strategies for high earners.

All contributions that you make are tax-deductible. You are allowed to put in. Overview of Tax Rules for High-Income Earners.

The contributions are tax deductible. Tax minimization strategies for individuals Income splitting with family.

High Income Earners Need Specialized Advice Investment Executive

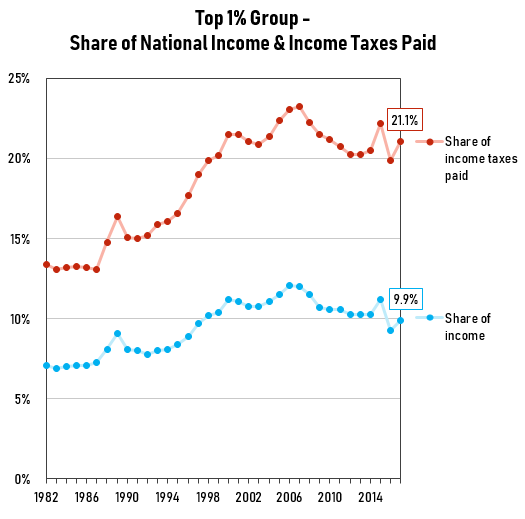

The Story Of The Rich Not Paying Their Fair Share Of Taxes Gis Reports

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Tax Planning For High Income Canadians Mnp

The Laval News Fraser Institute Says Quebec Families Earning 100k Or More Pay Highest Taxes

Canada S Laffer Curve Lesson Government Collects Less Revenue From High Income Earners After Trudeau Tax Hike Foundation For Economic Education

Wealth Tax Would Raise Far More Money Than Previously Thought Policy Note

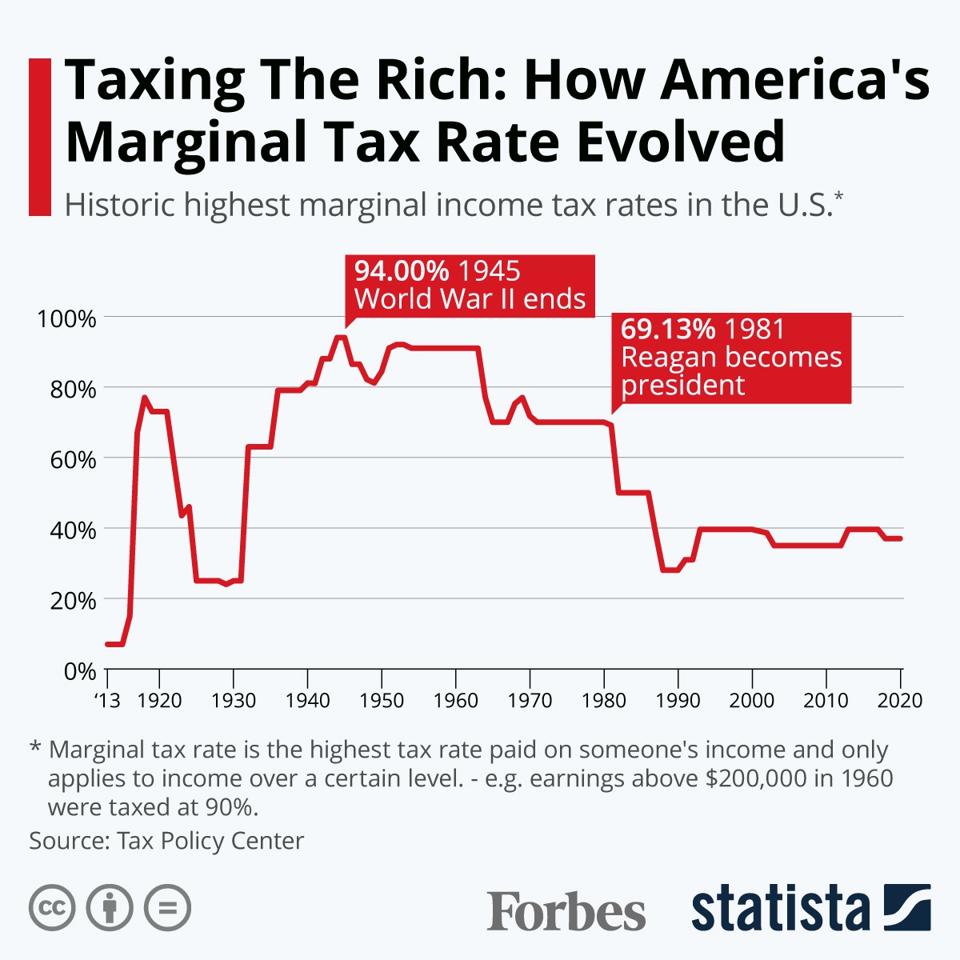

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

Us Super Rich Pay Almost No Income Tax Bbc News

10 Things Everyone Should Know About Taxation

The Revenue Effects Of Tax Rate Increases On High Income Earners Fraser Institute

Measuring Progressivity In Canada S Tax System Fraser Institute

2021 Taxes 8 Things To Know Now Charles Schwab

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News

Taxes For Canadians For Dummies Henderson Christie 9781894413398 Amazon Com Books